In this article:

- What’s the Minimal Home loan Matter You could potentially Borrow?

- What things to Be cautious about When looking for Small Mortgages

- How to find a little Mortgage

- Choices in order to Short Mortgages

- Getting your Borrowing from the bank In a position

Interested in a little mortgage might be perseverance. Of several loan providers divulge their limit financial matter offered, not their lowest, thus locating the best financing can also be cover some investigating.

For those who contrast lenders, you can find i don’t have necessarily a single lower important financial count. Instead, additional lenders has some other minimums. Here’s what to learn.

What is the Minimal Home loan Amount You could Use?

In terms of home loan items, for every single lender offers some other factors. Market research can tell you there are lots of type within the rates, closing costs and requires so you’re able to qualify.

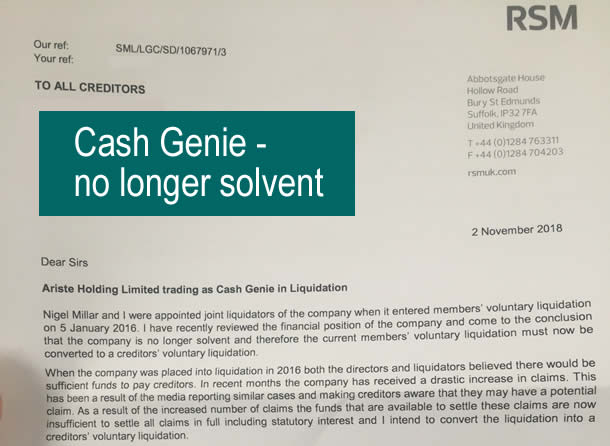

However, looking for a loan provider that offers quick mortgages normally present good special issue. With respect to loan quantity, extremely loan providers never disclose its minimums. Typically, you really have difficulties seeking a home loan lower than regarding $sixty,000, unless you are searching for a certain, bizarre mortgage style of (much more about you to definitely lower than).

If you find yourself financial minimums differ, certification conditions is apparently uniform around the lenders. Since you seek and you will get ready to apply for the right loan, continue such prominent requirements in mind:

- Credit history: There is no tough-and-punctual credit history one to qualifies you to own a mortgage, but some loan providers want a minimum rating off 620 (certain regulators-recognized mortgage loans features lower conditions). The higher your own get, the higher this new terms you’ll be able to qualify for.

- Functions background: Loan providers require promise your revenue try stable adequate to protection your mortgage costs across the long lasting, thus qualifying start around a requirement you have proof steady a job. Certain mortgage brokers actually want a-two-seasons list regarding work for your existing boss or even in your own current community.

- Downpayment: In the event you’re taking out a smaller-measurements of mortgage, their financial might require that you promote a few of their own money for the deal. Fundamentally, you will need to put down 20% of the price to get rid of investing private mortgage insurance. But many people can invariably select a lender even when it enjoys a down-payment as little as 5%.

What to Watch out for When looking for Quick Mortgage loans

In the event you are interested in a tiny financial, the details nonetheless number. If you are not cautious, borrowing smaller amounts can be more expensive than simply taking right out a large loan.

Settlement costs are one of the info you should pay romantic awareness of, since these will come off to doing 3% to cuatro% of one’s full cost. Additionally have to know your total focus rates. It might not take a look that very important to a smaller amount borrowed, however the difference in step 3% and 5% Apr on an effective $100,000 mortgage with good 15-12 months cost is over $18,000 for the focus costs.

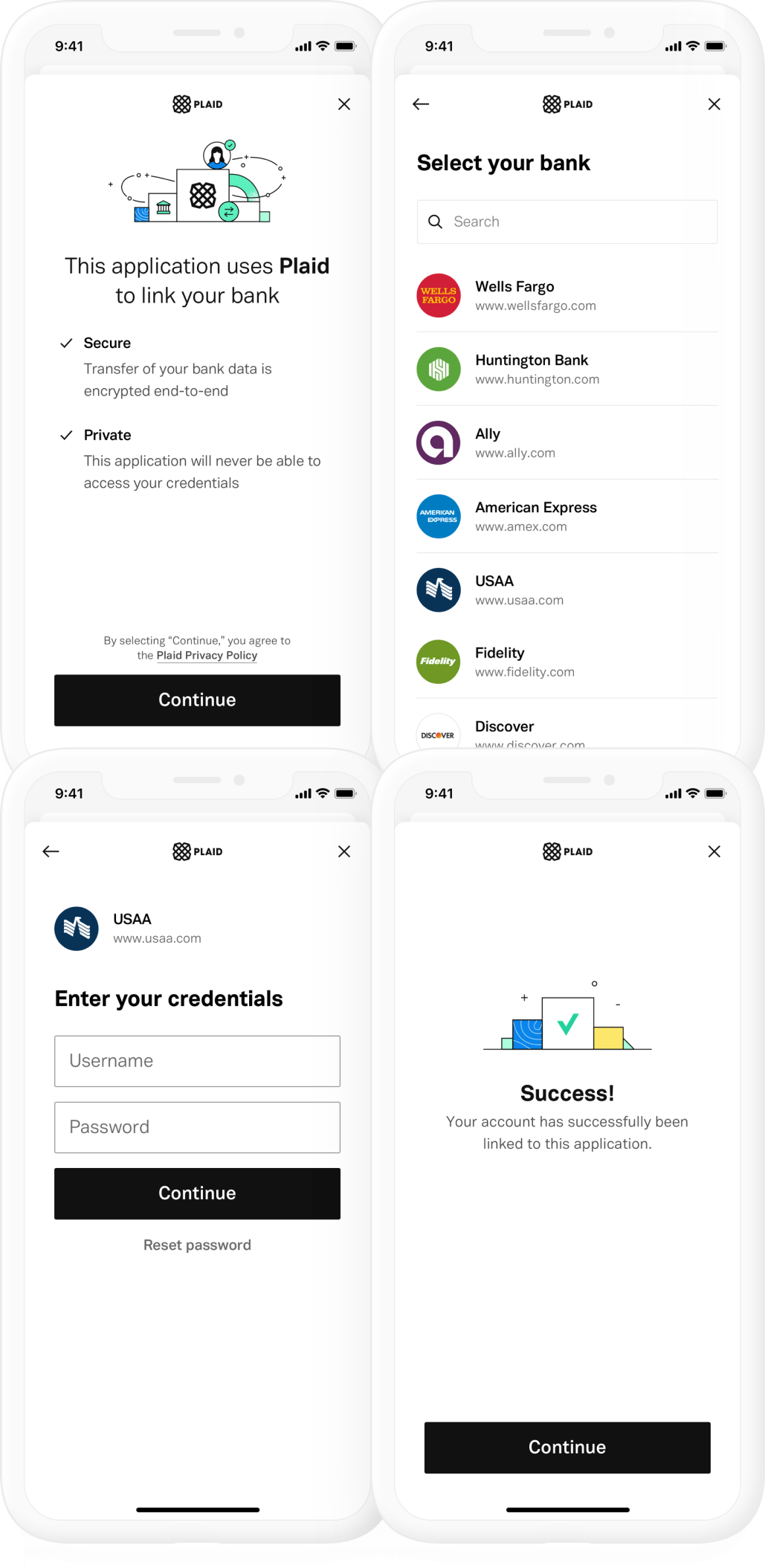

As with any financing you look for, make sure you compare will set you back and you can cost between you to lender and you will a different. Getting prequalification offers makes it possible to review estimates instead harming the credit, and also as yet another help you may use brand new proposes to negotiate most readily useful selling ranging from one to financial plus the next. Merely understand that words and you will rates you will alter if their credit or any other activities change after you sign up for the new loan.

How to find a little Home loan

While shopping around for the home loan, you may have to below are a few a number of particular loan providers, not simply larger banks. If you’re Lender off The usa also offers mortgages undertaking at $60,000, you might not get a hold of a unique bank of these dimensions to the office with you.

A region financial or credit union could be a lot more happy to run smaller-dollar financing otherwise has actually special incentives to get your area. Secret Lender, hence operates during the fifteen You.S. states, features another Area Mortgage system and no minimal amount borrowed having mortgages. To help you qualify, you may need to satisfy special requirements, and additionally attendance of a great homebuyer knowledge workshop.

Alternatives so you can Quick Mortgage loans

Instead, you may be able to find the cash need rather than taking out fully an interest rate. In lieu of providing that loan that needs your home as the collateral, you could try qualifying to possess a personal loan. Only understand that rather than collateral, your interest rate can be a lot higher.

You might like to was becoming more certain about the version of loan need. If you are planning to invest in a little house, is actually appearing especially for smaller-home resource.

When you are looking for a condo, come across loan providers who promote condominium-specific loans, including the Government Houses Government (FHA). The process of delivering accepted for this kind of mortgage can be be a while different from a simple financial, so you might need certainly to allow your lender discover initial. While you are seeking delivering an enthusiastic FHA mortgage, try carrying out your pursuit that with observe acknowledged devices for the your area.

Getting the Borrowing from the bank Able

If you would like a tiny-dollars real estate loan, looking a loan provider is https://paydayloanalabama.com/atmore/ almost certainly not your own just test. Regardless of if you happen to be borrowing from the bank smaller amounts, with poor credit or no borrowing may get in the manner of your own recognition.

Upfront shopping around, eliminate your own totally free credit report and you can rating to see where you remain. Verify if there’s area to possess improvement or if around was discrepancies you can target in your credit reports. Getting this task, before taking out financing, may help you be eligible for finest cost and you will help you save an effective bundle in the long run.

Curious about your own home loan alternatives?

Speak about custom choice away from numerous lenders and make informed behavior from the your property resource. Control qualified advice to find out if it can save you tens of thousands of bucks.