When you are thinking about building at your house . unlike to find you to definitely, you are probably going to need a secure loan. Because there is not even a physical the home of act as collateral after you pick blank possessions, the fresh home resource procedure performs differently from obtaining home financing. Even though it may sound perplexing initially, cannot worry belongings loans commonly just like the tricky as you may imagine.

Let us break down just what an area mortgage was, how it operates and how you can make use of one to select the best little bit of a residential property to possess any sort of you may be building.

What’s A land Mortgage?

A land financing is employed to finance the purchase from good plot of land. The newest terms and needs of these loans will vary established about how new borrower intends to make use of the residential property of course they propose to get it done. Such as for example, lots you to definitely consumers decide to create to the instantaneously or perhaps in the brand new forseeable future might have less limiting standards than loads bought because of the individuals without strong building plan in position. New nearer new residential property is to try to being able for building so you’re able to initiate, the easier and simpler it will be to get investment, also a great deal more positive rates of interest and you may advance payment conditions.

You can find around three types of homes that exist a financing getting raw land, unimproved property and you can improved home.

- Raw belongings is entirely undeveloped home and no strength otherwise utilities generally Orange Beach loans. This type of parcel can be difficult to get financial support to possess without having an extremely solid propose to create the property. Rates of interest and you will down-payment standards is higher to possess raw residential property money as well. In some cases, you may need to make an advance payment as much as 50 % of the worth of the mortgage.

- Unimproved belongings is like intense home it is typically some more successful and may have access to certain utilities. Unimproved home can often be a little convenient and a lot more sensible to finance than just intense land.

- Enhanced residential property are homes who has got use of utilities, routes, business, etc. As the it’s the extremely arranged types of residential property, such loads may cost more raw or unimproved residential property however, interest levels and you may deposit requirements getting increased home are down.

How can Belongings Funds Performs?

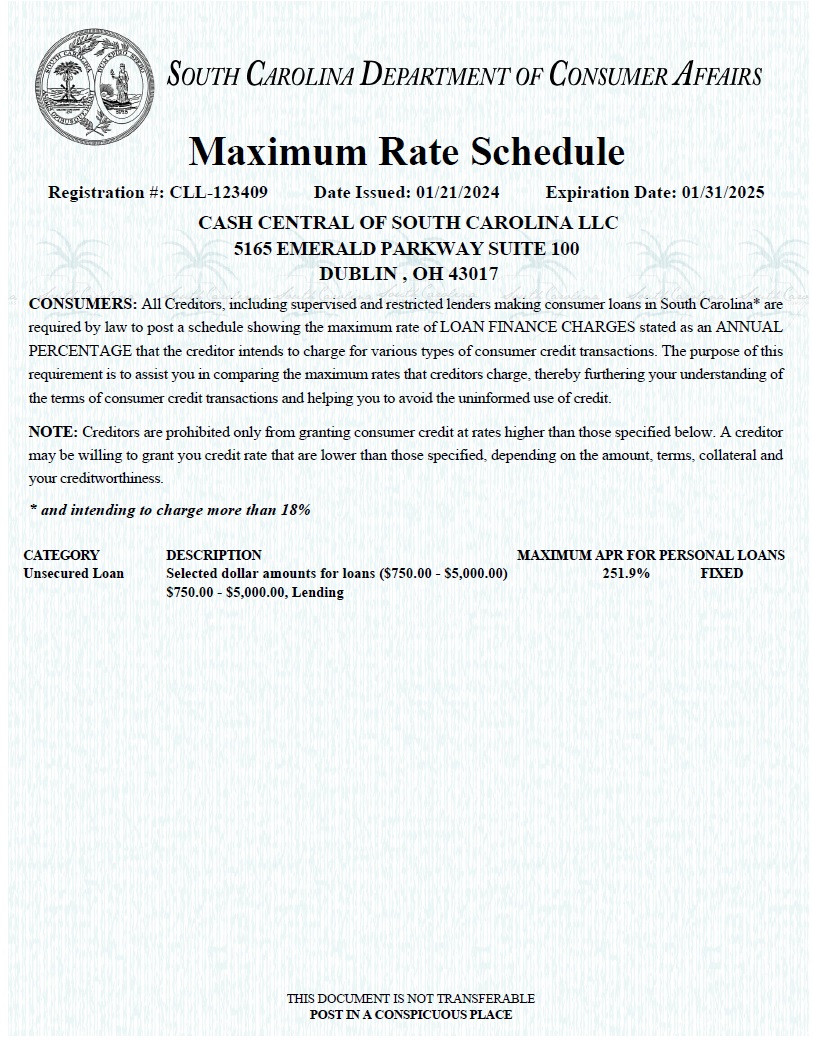

Bringing a secure mortgage can be a bit much like the process of taking a mortgage. Same as resource a house, you will need to enjoys a good credit score, a minimal debt-to-money ratio (DTI) and you will enough currency making a deposit. Residential property funds are considered riskier than simply mortgage brokers, although not, because there is no possessions toward bank to use because security. To help you be the cause of it risk, such financing normally have high down payment requirements and better interest cost.

Belongings loans will often have much reduced terms and conditions than simply regular lenders, as well, having financing lengths regarding dos 5 years getting well-known. At the end of the borrowed funds title, many home loans need a beneficial balloon commission to settle the fresh balance of the mortgage. If you’re considering providing a secure financing, you can even contemplate whether or not you might develop your possessions before the balloon payment arrives.

What is the Difference between A homes Mortgage And you will A land Mortgage?

A property mortgage is a type of quick-title property mortgage designed to render borrowers to the money so you can purchase belongings and create a home. Such fund are occasionally setup to convert from a construction loan to help you an everyday otherwise permanent real estate loan pursuing the home is founded. Framework finance features terms of to 1 year, right after which the dog owner must possibly move its financing so you’re able to an effective mortgage or get you to definitely. These loans are intended for individuals which might be ready to make immediately. Typical homes financing, on top of that, function better designed for borrowers that do not has quick intentions to create.