Also, apply for a sales tax permit from the Florida Department of Revenue. In fact, sales tax returns should be filed periodically, and the collected sales tax should be sent to the state. When you opt for S corp taxation, you only pay self-employment taxes on your paychecks. Additional income, known as distributions, is only subject to your regular income tax rate. This benefit becomes worthwhile around $40,000 to $80,000 in annual business income due to the savings on self-employment taxes.

- For certain transactions, only the first $5,000 of a taxable sale or purchase is subject to the discretionary sales surtax.

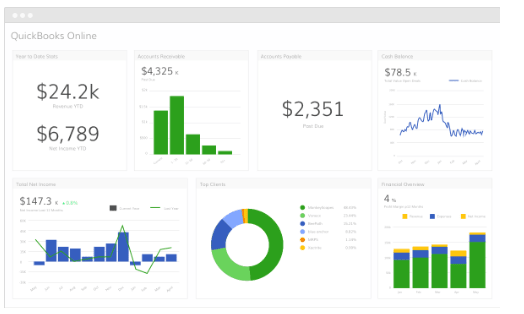

- You can keep track of income and expenses using Microsoft Excel or Google Sheets.

- When you own an LLC, it’s important to figure out your LLC tax rate, so you know what you’ll owe when tax season comes around.

- A 529 plan is a tax-advantaged investment account designed to help families save and pay for a college education, graduate school, or another form of higher education.

- It is also a great option for companies that need tools to pay employees fairly while keeping payroll costs to a minimum.

- Furthermore, the business must be a legitimate company with a valid business license and be engaged in activities that are beneficial to the community.

- C-corps in Florida need to pay the federal corporate income tax of 21% and the state corporate income tax of 5.5%.

File Using the Modernized e-File (MeF) Program

The platform offers a checkbox option to invite the added employee or contractor to fill out the rest of the information themselves. Though this process was straightforward, manually entering several people could get tedious for companies with high hiring volumes. To learn more about Florida corporate income tax, florida income tax visit the FL Department of Revenue website. Moreover, an LLC’s taxable sales and the applicable tax rate determine the collected LLC sales tax amount. There is no state income tax on individuals or businesses in Florida. That is why Florida LLCs will not have to pay any state income tax on their profits.

Florida LLC Taxes FAQs

- To access payroll features in the first two tiers, you have to first purchase the core plan and then pay $6 per employee per month more to access the payroll add-on.

- Most 529 plans have very low minimums required to open an account—some as low as $0.

- Also, time off data doesn’t necessarily sync with payroll or an employee’s time off information in their profile.

- Yes, all Florida LLCs have to pay an annual fee by filing a Florida LLC Annual Report every year.

- So, no matter in which state you open up an LLC, you will always have to report taxes at a federal level to the IRS.

Or maybe you heard that it’s a type of “investment” account, and you’re not sure if that’s right for you. Rippling earns a 4.8 star rating on G2 with 2,2802,800 https://www.bookstime.com/ user reviews and a 4.9 rating on Capterra with more than 3,000 user reviews. Its users praise the platform for its user-friendliness and clean user interface.

Florida Annual Resale Certificate for Sales Tax

Finally, for employees, it will manage your unemployment taxes and claims on your behalf. In addition, ADP RUN offers all the features you’d expect in a payroll service. It has tiered plans with payroll by direct deposit, a self-service employee platform, new hire onboarding and optional benefits administration for additional fees. More advanced plans include a robust HR platform, including an employee handbook, document management, training programs and employee toolkits.

They also don’t require a state income tax return for Multi-Member LLCs, unless one of the owners of the Multi-Member LLC is a corporation. You can register online to report, collect, and pay sales tax to the DOR. You can report and pay these taxes either online or by submitting Form DR-15. Depending on how much sales tax you collect, you’ll report and pay taxes either monthly, quarterly, semiannually, or annually. Congress raising the corporate tax rate in 2025 is an opportunity to recoup some of the truly obscene profits corporate America raked in during this period of economic upheaval for American families. Instead of having multiple IRAs, you might have a Roth IRA and a brokerage account.

The 4 Ways an LLC Can be Taxed

And then the IRS would mail you an Approval Letter to confirm you’ve chosen the Corporate tax election for your LLC. If your LLC has more than one Member, your LLC is taxed as a Partnership. If you have one Member, your LLC is taxed as a Sole Proprietorship.

Tax planning strategies such as deferring income or taking advantage of deductions can help reduce your taxable income. In Florida, the Department of Revenue administers the excise tax credits for businesses. This means you don’t have to file a state-level income tax return for your Florida LLC income if you have a Single-Member LLC. Instead, the LLC Members are responsible for reporting the income (or losses) on their personal 1040 tax return. So, employers don’t need to worry about withholding employee wages at the state level. When you set up a 529 plan, you choose from a selection of strategies for investing instead of choosing specific stocks or bonds.

How Are Florida LLCs Taxed?

LLC Taxation for Non-US Residents in 2024: The Ultimate Guide – Nomad Capitalist

LLC Taxation for Non-US Residents in 2024: The Ultimate Guide.

Posted: Tue, 25 Jul 2023 12:14:26 GMT [source]

TriNet helps small businesses save money by looking for tax credits for each company. For example, it allows you to input tax credit information into the payroll system and then prepares forms 8974 and 941 for you to claim those credits. From this screen, I was also given the option to import time tracking data from ADP’s time and attendance add-on or another time keeping software.

Other Benefits of Investing in a 529 Plan—Jumpstart a Roth IRA

When determining how often to pay the sales tax, you’ll have to choose whether you will file it annually, bi-annually, quarterly, or monthly. This is wholly dependent on how you choose to submit the payment. Some businesses find it easier to submit payments monthly, to prevent higher costs if paying less frequently.