Remodeling can be inhale new way life to your possessions without the challenge of transferring otherwise thinking of moving a special town. Plus, it may be a lot of fun and another to get happy with at all, you will be designing and you will co-performing the place you name home.

A personal loan

To greatly help funds small or typical home improvements, you might pull out a consumer loan. Typically, you might borrow from only $5,000 to $50,000 with Pepper Money this can be an alternative when you need to liven up your bathroom or kitchen.

Regardless of if unsecured personal loans usually have a top rate of interest than just a mortgage, taking out fully a personal bank loan would-be less than just refinancing your present financial along with your established bank otherwise a new financial.

Refinancing

If you were in your property for a time, you are able to re-finance your home loan, letting you utilize their equity. An easy refresh – collateral is the difference in the outstanding loan harmony additionally the current lender examined property value your residence. Subject to a beneficial lender’s credit check and you can credit conditions, you may be able to refinance doing 80% of one’s property value your house to fund renovations.

Refinancing your house loan you’ll enables you directory to buy your own renovation at home financing rates of interest which will constantly be more aggressive compared to the interest rates billed towards an unsecured personal loan.

There are about three preferred methods use refinancing to fund your own restoration; cash-out, advances repayments or together with your savings.

Helpful information on how best to package your home repair

Remodeling a house was fun nevertheless also can be good part challenging. After all, we would like to create your fantasy home as opposed to breaking the lender. This is exactly why it is very important enjoys a realistic concept of what anything will surely cost earlier swinging the latest hammer.

step one. Extent any project

Before you get out the latest sledgehammer otherwise acquisition a cooking area benchtop, it’s best to make sure to contemplate that which you need. Could you already have items in mind in this case, could there be a lead-big date connected, or will they be into the stock? Normally the renovations believe in Doing it yourself, otherwise will you need licenced tradies for the task? Just as, with big home improvements, needed council, strata otherwise bank recognition. Most of these devote some time, making it important to score what you co-ordinated prior to getting already been.

2. Plan your repair funds

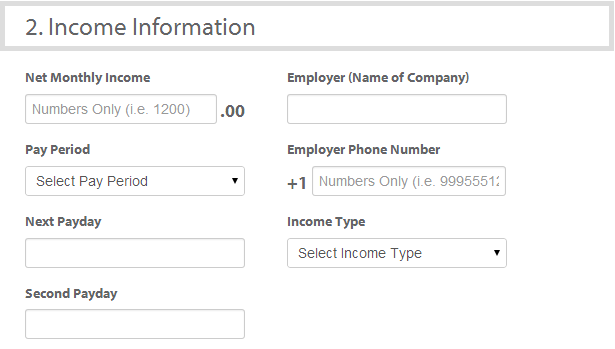

When you’re using that loan for the repair, after that chances are high you take to the a more impressive opportunity, so believe and you may budgeting might possibly be trick. Depending on your priorities and also the complexity of your restoration, it is possible to stumble on unanticipated costs including electrician and you will plumbing work costs.

Plus one even more situation – it could be smart to plan into the a supplementary buffer on top of your financial allowance to cover unanticipated will cost you.

step three. See peer support

There’s absolutely no spoil when you look at the requesting assist or trying recommendations. Of course, if you don’t have an experienced reily otherwise friendship classification, you could potentially turn to community forums (particularly Homeone’s Domestic Reazed within insightful degree provided upwards as well as may even offer one more piece of determination you hadn’t idea of.

4. Price and you may contrast

It is best to inquire about service providers to incorporate a breakdown away from work and you may question costs in order to select in which people possible savings may be.

5. Don’t forget plans B

Bundle that which you and it’s best that you provides a backup. It can help having an alternative if an individual part of your plan cannot go-ahead. It is possible to rapidly adapt and you can lso are-station the repair in order to package B.

Your first suggestion might changes or build along the way because you have made estimates regarding masters, extent aside information and commence the loan recognition procedure (if needed).

Tips on how to upgrade on a tight budget

If you just want to carefully rejuvenate your house space, you might think these ideas to remodel with the a good budget.