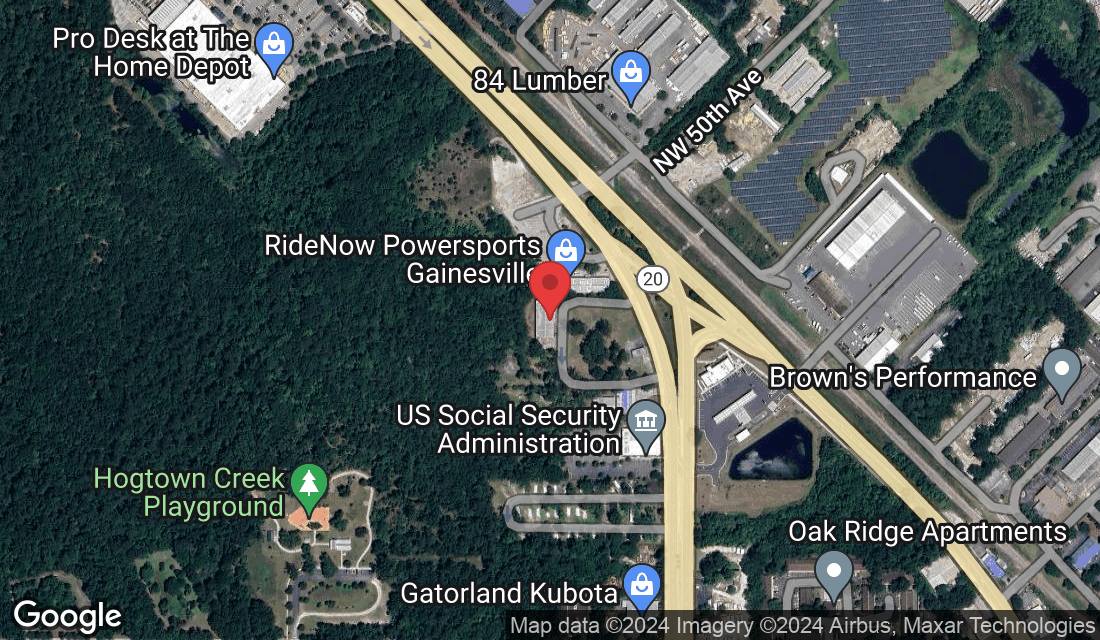

Imagine if you will get doing $twenty five,one hundred thousand for your house pick just as an initial responder, firefighter, police, otherwise military professionals? Better, anybody can! It would help for folks who satisfied certain Home town Heroes Financing Program requirements. Including, their to order home need to be in the Orange Condition, Florida.

Of many basic-big date homebuyers don’t believe that they’ll be eligible for a loan themselves because they do not are able to afford saved up to own a deposit otherwise as they provides bad credit regarding prior errors in daily life such as for instance getting into loans otherwise which have a great bad credit history due to later money if not case of bankruptcy situations. But discover solutions to help you basic-go out homeowners having income lower than 80% AMI that can not have come sensed in the past while they imagine they will not be able to qualify for a loan towards their own.

Home town Heroes Financing System

Do you realize regarding Hometown Heroes Financing Program, a course for people in the military and you can earliest responders, such cops and you may fire, medics, plus instructors? Great news! So it financing system happens to be for sale in Main Florida.

The newest Home town Heroes Loan program is for members of this new army and you may basic responders, such as for example police and you will fire, medics, and also coaches. The latest fund were created to aid these heroes get land inside Central Florida.

You don’t need to spend any money straight back in case the app is eligible! If in case it is really not acknowledged, there isn’t any spoil over – zero credit score is affected by implementing.

But what if the I am not eligible?

Unfortuitously, it is not accessible to folk: solely those that are accredited around Name 38 can put on (and there are plenty of qualifications).

Survivors applying inside couple of years following the loss of a lives mate otherwise slight kid because of death when you are undertaking army provider obligations

Retired service players receiving retirement pay at the least 50% impairment rating otherwise equivalent payment centered the size of solution rendered

- Medical professionals

- Nurses

- Coaches

$25,100000 to your household buy

The Hometown Heroes Foundation deliver earliest responders, pros, or any other hero benefits $twenty five,000 buying their homes. Normally, zero advance payment is necessary. There are even no monthly obligations or appeal costs needed into the financing. Truly the only requirement is that you live in the house to own at least eight age immediately after closing.

The applying work along these lines

You might pick any house into the Fl one costs below the most number place so long as they fits HUD guidance (discover “Hometown Heroes Program Criteria” below).

The new Home town Heroes Foundation will give you an offer out of right up so you can $25k towards the buying your new house. Suppose the loan comes out to help you less than what the Hometown Heroes Basis anticipates (it needs to be based on equivalent conversion process research from inside 30 miles regarding where you stand buying the possessions). Therefore, they’ll enhance their give appropriately up to the restriction matter might have been hit.

Because of this no matter if i don’t have sufficient security remaining right after paying out of people liens contrary to the house just after buying they (when the there are one), might nonetheless give us enough currency for all of us without got one thing appear yet ,!

Actual rebates

The fresh Home town Heroes system isnt financing. Its an immediate cash rebate and you may coupons system you can apply towards your household pick otherwise refinance closing costs.

Home town Heroes are a nationwide provider from a home functions who may have partnered which have hundreds of local realtors installment loans Richmond Texas in pretty much every county and you may state across the You.S to provide worthwhile savings on the real estate fees.