While you are not able to get a personal loan perhaps due to a low-income or a woeful credit record a beneficial guarantor financing can also be open the doorway to credit because requires the financial support away from a pal otherwise partner. But, the fresh money come with dangers, therefore both parties is to on their homework first.

What is actually a guarantor financing?

Anyone acting as this new guarantor agrees to meet up with the borrowed funds payments in the event the debtor struggles to spend, effectively guaranteeing’ her or him and you can providing the financial institution to progress the money from the a reasonable rate of interest.

Who will become a good guarantor?

The new guarantor might be somebody you know perfectly always a near friend or family member. In some instances a father will act as the fresh guarantor for their man, such as. Nevertheless the guarantor should not have any monetary link to the new debtor, such a mutual family savings.

Guarantors often have as older than 21. New guarantor requires a robust credit rating and you may a good United kingdom savings account. Certain loan providers require the guarantor getting a citizen.

What are the drawbacks?

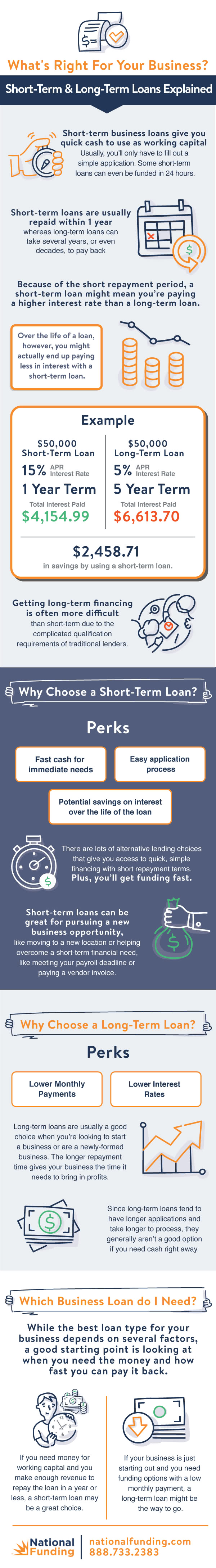

The eye rates energized to the guarantor money are generally higher than that of a normal consumer loan (instead an excellent guarantor). There’ll additionally be less assortment of organization when shopping up to to own a good guarantor loan compared to greater personal bank loan sector.

Demonstrably, playing with a guarantor arrangement you are going to put a-strain towards the relationships between your borrower plus the guarantor in the event your borrower incurs cost troubles as well as the guarantor must help to installment loan Hamilton WA spend.

Guarantor financing can offer consumers the opportunity to rebuild their borrowing from the bank record where they may have experienced difficulties in earlier times. However, individuals have to be truthful through its guarantor about their finances and you will ability to pay.

Guarantors need certainly to be satisfied they may be able believe new debtor and that the fresh credit try sensible with the debtor to manage and now have that they, the new guarantor, you may comfortably meet with the costs in the event that one thing was to go wrong.

Which are the risks on the guarantor?

When a good guarantor believes so you can right back the mortgage they getting in charge in making brand new month-to-month money if for example the debtor defaults and should not pay.

The expression of financing will be enough time five years, such as and you will guarantors are not able to eliminate themselves just like the an effective guarantor until the loan he or she is backing has been paid down in full.

In case your loan try secured’ then your guarantor’s home will be on the line when your borrower defaults to your payments as well as the guarantor is additionally incapable to pay. This is simply not the situation to own unsecured guarantor money, but the financial will nonetheless go after this new guarantor for the repayment of the loans, perhaps through the process of law.

It is essential to query the financial institution how they list this new guarantor loan account with the borrowing source enterprises till the debtor removes the loan. When it is deemed a joint mortgage membership, it does immediately appear on brand new guarantor’s credit score, which need not be a challenge if for example the financing is actually securely maintained and you may paid off.

In some cases the loan will simply appear on the credit document of the debtor. Although not, in the event the debtor misses a payment plus the guarantor is known as to make their requested fee to pay for standard, up coming accurate documentation will usually appear on the guarantor’s credit reports at that point.

This may negatively impact the guarantor’s very own credit history as well as their capacity to score credit afterwards due to the fact lenders you will infer that they’re economic stretched.

Ombudsman concerns

The new Monetary Ombudsman Provider (FOS), hence deals with user problems regarding the controlled lending products, enjoys viewed a massive increase in problems about guarantor funds.

Specifically the latest FOS notices of several grievances out of consumers the mortgage are unaffordable which lack of checks had been done-by the lender.

Complaints made by guarantors is that the mentioned guarantor had not wanted to new plan, otherwise that the effects to be good guarantor just weren’t safely explained first. Some whine about unexpected injury to its personal credit record.

It is very important comprehend any fine print of the loan arrangement and you will price before signing upwards you to definitely applies to the brand new debtor and also the guarantor.

Both sides when they are aware of the risks and you may loans, and how details about the loan is registered on the borrowing from the bank resource companies.