To start the latest degree process with the Education loan Planner to remain bonus, people need to pertain on the hook up offered toward reliable.

All of the bonus payments was by elizabeth-gift card. Pick conditions. The level of the advantage will depend on the financing matter disbursed. In order to discover so it added bonus, customers will be required accomplish and you can submit a good W9 function along with requisite data. Taxation would be the only obligations of one’s receiver. A consumer only be eligible to receive the main benefit you to date. Brand new individuals are eligible for only one added bonus. Most conditions and terms pertain.

To your $step 1,250 incentive associated with the refinancing no less than $100,000, $five-hundred of added bonus is offered from the Education loan Planner via Giftly, and that’s redeemed as the a deposit on the savings account otherwise PayPal membership. Abreast of disbursement out-of a being qualified financing, new borrower need certainly to alert Education loan Coordinator that a qualifying mortgage is refinanced from the website, once the bank doesn’t express the fresh new names or email address out-of consumers. Borrowers have to complete the Refinance Incentive Consult mode to allege a good added bonus provide. Education loan Planner tend to establish mortgage qualification and you may, through to confirmation off a being qualified refinance, will be sending via email a good $five-hundred e-provide cards inside 14 business days pursuing the last day’s the latest week where qualifying loan was confirmed eligible because of the Education loan Coordinator. If the a debtor will not claim the newest Education loan Coordinator bonus within this half a year of one’s loan disbursement, brand new debtor forfeits the straight to allege said added bonus. The advantage number relies upon the loan amount paid. It bring is not good to possess borrowers who possess prior to now obtained an advantage regarding Student loan Coordinator.

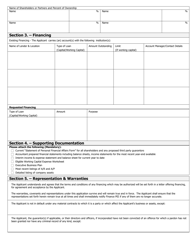

TD Lender real estate loan software techniques

The lenders towards the Credible system offer fixed costs between 4.74% % Apr. Adjustable rates given by the lenders towards Legitimate range from cuatro.86% % Apr. Adjustable prices commonly vary across the label of your own borrower’s loan that have changes in the fresh Index rate. The fresh List was either LIBOR, SOFR, or perhaps the Finest Interest while the published regarding the Wall structure Path Journal (WSJ). Maximum varying rate on the Degree Home mortgage refinance loan ‘s the higher regarding % otherwise Primary Rates including 9.00%. Rates try subject to alter any moment without warning. The actual speed tends to be distinctive from this new prices claimed and you may/otherwise found over and will be considering affairs such the expression of mortgage, debt record (together with your cosigner’s (or no) financial history) in addition to degree you are in the whole process of reaching otherwise features attained. Whilst not constantly the way it is, lower rates generally require creditworthy individuals with creditworthy cosigners, graduate values, and you can faster cost words (words are very different from the lender and will may include 5-2 decades) you need to include support and Automated Commission coupons, in which relevant. Support and Automatic Payment disregard requirements as well as Lender words and you may criteria vary by the lender and that, studying for every lender’s disclosures is very important. While doing so, loan providers might have mortgage minimum and you can limitation conditions, education requirements, informative facilities criteria, citizenship and house criteria as well as other financial-certain criteria.

This post may contain member links, for example Education loan Planner may discover a payment, at no extra cost to you personally, for people who click right through to make a purchase. Delight comprehend all of our full disclaimer for more information. In some cases, you can see a far greater bargain from your ads partners than simply you could obtain through the products or services privately. This content isnt given otherwise accredited from the people financial institution. People views, analyses, evaluations otherwise pointers expressed in this article are those of your journalist by yourself.

Financial and you may Bonus disclosure

This type of examples render rates according to money beginning instantly up on financing disbursement. Adjustable Annual percentage rate: A good $ten,000 mortgage which have a good 20-12 months name (240 monthly installments from $72) and you may a beneficial 5.89% ount from $17,. To have a varying financing, shortly after their doing rates is set, your price will differ with the markets. Repaired Apr: A great $ten,000 mortgage that have a good 20-seasons label (240 monthly payments of $72) and you will a six.04% ount of $17,. Your own real payment terms can vary.Small print pertain. Check out age-mail you at , or call 888-601-2801 to learn more about our education loan re-finance device.

Pricing is actually at the mercy of changes without notice. Not absolutely all applicants usually qualify for a decreased rates. Lowest rates are reserved for creditworthy candidates and will depend on credit rating, mortgage title, or other facts. Reasonable rates may require an autopay discount out of 0.25%. Adjustable ounts at the mercy of improve or disappear.

Costs at the time of 9/. Prices Subject to Changes. Fine print Use. All the facts at the mercy of borrowing recognition. Laurel Road disclosures. To qualify for this Laurel Road Invited Added bonus promote: 1) no one should already be an enthusiastic Laurel Street client, otherwise have received the bonus in past times, 2) you must complete a completed education loan refinancing app from appointed Student loan Coordinator link; 3) you need to provide a valid email and you can a legitimate checking account number into the app techniques; and you will 4) the loan must be fully disbursed. If a debtor is eligible for and you can decides to deal with an interest advertisements render due to that borrower’s membership for the good elite group association, the fresh debtor are not qualified to receive the bucks bonus off Laurel Path. Yet not, the fresh new debtor can nevertheless be entitled to the newest Education loan Planner added bonus if they meet the requirements underneath the Student loan Planner Extra Revelation words below. If you opt to get the dollars incentive added bonus promote, might located a $step one,050 bonus if you re-finance $100,000 or maybe more, otherwise a beneficial $3 hundred extra for those who refinance an expense off $50,000 so you’re able to $99,. Into $step 1,050 Welcome Incentive bring, $five-hundred would be repaid physically by the Education loan Planner thru Giftly. Laurel Road commonly immediately shown $550 into family savings adopting the finally disbursement. Into the $3 hundred Enjoy Incentive render, Laurel Highway commonly immediately aired the fresh new $3 hundred added bonus towards checking account pursuing the finally disbursement. Discover a limit of just one added bonus for every single borrower. This give isnt good having latest Laurel Road clients just who re-finance the established Laurel Path financing, members who possess in past times obtained a plus, or having other extra now offers acquired away from Laurel Road via that it and other channel.

Credible: For individuals who refinance more $100,000 through this webpages, $five-hundred of one’s cash added bonus mentioned above emerges physically of the Education loan Coordinator.