Because children wait a little for a decision regarding U.S. President Joe Biden into the a possible extension of your own pause toward student loan payments, world observers keeps cautioned regarding you’ll be able to frauds of these repayments.

Previous Chairman Donald Trump very first paused such money in the delivery of your own ongoing COVID-19 pandemic and you will Biden adopted suit, stretching they up until the stop of the week.

A week ago, 100 Home and you can Senate people closed a page contacting Biden to extend the modern stop on student loan money past August 29

White Home press secretary Karine Jean-Pierre recently informed journalists that Biden will soon “make up your mind” towards the maybe stretching the brand new stop once again. “I’ll help your cam,” Jean-Pierre told you.

WATE-Television journalist Wear Challenge recently acquired one among these con phone calls and you will reported it into Bbb (BBB) inside the Tennessee.”The reason we are contacting is because your own education loan are entitled to a forgiveness system. We require your agreement to accomplish the procedure. Excite name all of our workplace situated in Tennessee at 423. BEEP,” a tracking of phone call said.

The newest CFPB as well as advised pupils to stop these types of frauds by watching aside to own unnecessary charge to possess mortgage forgiveness costs by perhaps not giving out one personal data over the phone

Just after revealing the phone call, Dare talked which have Tony Binkley of your own Better business bureau out-of Deeper Eastern Tennessee, just who called the matter.

“One of the questions Used to do query during the the discussion try could you be situated in Tennessee? They told you, zero, the audience is inside the Irvine, California. He or she is a bona-fide company having a real target. not, their site is really suspect. It is rather, simple. It’s hard locate someone on the cellular telephone. There had been only lots of red flags…upwards for me resource,” Binkley told you, predicated on WATE.

“Whenever someone are getting in touch with your without warning, this will be dialing to possess cash. They are just dialing upwards anyone they can,” Binkley is actually quoted by local news route. “Develop, they are going to score a hit, someone who in reality comes with a student loan-someone younger than simply your otherwise myself-hoping they’re able to prey on the data which they do not have.”

Within the April and may, the fresh Better business bureau, the consumer Monetary Cover Agency (CFPB) and Government Change Percentage (FTC) all the cautioned from you’ll education loan forgiveness cons.

“Scammers you are going to vow financing forgiveness system-that most individuals wouldn’t be eligible for. Or they may state they’ll eliminate your own funds because of the disputing them. Nonetheless cannot produce toward a beneficial forgiveness system that you do not qualify for otherwise get rid of the financing,” new FTC told you into the a press release for the s of the maybe not discussing the Government Student Support (FSA) ID.

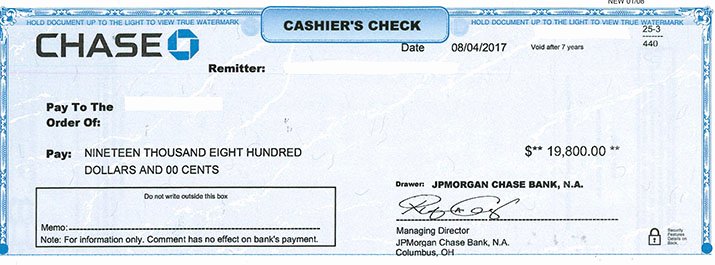

Inside the a comparable pr release, new CFPB said, “Numerous student loan consumers has just submitted problems into the User Financial Safety Bureau throughout the companies that assured them education loan forgiveness or mortgage forbearance in exchange for charge amounting so you can numerous otherwise thousands regarding bucks.”

The brand new pr release went on, “Consumers experienced they certainly were talking to the servicer otherwise a family approved by the Agency away from Training because they tend to know personal guidance including the borrower’s mortgage harmony or previous consolidation pastime. This is swindle.”

- American Exodus? Why Us citizens Try Fleeing Specific Says and you may Transferring to Anyone else

- Education loan Upgrade: 100 Domestic, Senate People Query Biden to extend Pause

- Is Student loan Forgiveness Going on? Everything we See To date

Inside an announcement sent to Newsweek, a representative towards the International Relationship of Best Providers Bureaus told you most education loan forgiveness scams was in fact “categorized less than ‘Credit Resolve/Debit Relief’ into the Swindle Tracker.”

The brand new Agencies of Studies as well as responded to Newsweek’s request for feedback and you can considering an announcement away from Government Beginner Assistance Head Operating Manager Richard Cordray.