During the Colorado County Affordable Homes Business (TSAHC), we help each other very first-go out home buyers and repeat people get a house. Our company is a beneficial nonprofit business which had been developed by the newest Colorado Legislature to simply help Texans achieve its imagine homeownership. Let’s make it easier to purchase your fantasy domestic.

Before-going Then

Step one to find out if you qualify is to try to grab our very own on the web Eligibility Test. It takes merely minutes therefore don’t require unique documentation. The latest quiz allows you to determine if you meet the system conditions together with type of advice you be eligible for. So you can qualify, you’ll want a credit history away from 620 and fulfill specific earnings criteria.

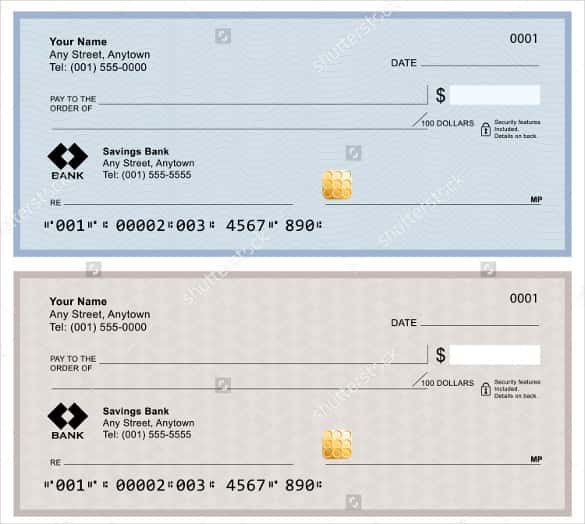

Once you buy a home, you always need certainly to and additionally make a deposit. New downpayment demands is equivalent to a percentage of your cost of the house and can differ in line with the type regarding financing you obtain. Like, if the a property costs $one hundred,100 and you may a down payment of 5% is needed, you must pay $5,000 in the course of get.

If you are eligible for all of our programs, TSAHC gives you a mortgage loan and you will financing to have fun with to suit your down-payment. You can choose get the down payment assistance given that an excellent give (hence need not end up being paid back) or a good deferred forgivable 2nd lien mortgage (and therefore only has to be paid back for many who offer otherwise refinance inside three years). If you are eligible, you could generally discover free currency to help you purchase an excellent family.

The degree of the deposit depends on several things, as well as your money, the loan type of, the degree of TSAHC recommendations of your preference, the expense of your house, and how far you want to use. The bigger your deposit, elitecashadvance.com/installment-loans-ca/los-angeles the smaller your own month-to-month mortgage payment is. The smaller your down payment, the higher your own month-to-month mortgage payment.

Your own financial will assist you to figure out which TSAHC direction option to decide and exactly how far you ought to lay out into the your house.

Your bank will also help you figure out which TSAHC system your qualify for. Each other applications supply the exact same deposit guidelines alternatives.

Land getting Colorado Heroes System If you’re for the a character industry, here is the home loan system to you. Hero disciplines become:

- Top-notch coaches, which has another full-time positions when you look at the a public school district: college coaches, professor aides, college or university librarians, college counselors, and college nurses

- Law enforcement officers and you can public coverage officers

- Firefighters and you will EMS employees

- Experts otherwise productive armed forces

- Modification officers and you will juvenile changes officials

- Medical faculty and you may allied wellness professors

Domestic Nice Tx Mortgage Program Otherwise meet the requirements under one of several professions listed above, this is the ideal system to you.

If you’re purchasing your earliest house, you may want to apply for a mortgage desire taxation borrowing identified given that a mortgage Credit Certification (MCC). In order to qualify, you need to meet specific money criteria and also the house need to meet particular transformation rates constraints.

Step one is to try to take our small on line Qualifications Test. Which test will say to you regardless if you are qualified to receive our very own guidance.

If you’re eligible, this new test will assist you to make contact with an using bank in your area. The financial institution will assist you to fill out the applying. You will not submit things right to TSAHC.

You will additionally be required to over an approved household visitors studies movement before closing in your family. We don’t need you to focus on a particular Realtor, you could utilize this research unit to obtain a representative accustomed our very own programs.

What people Say On TSAHC’s Programs

To buy property is the greatest monetary choice we now have ever made, so we wouldn’t do they without the downpayment grant we obtained away from TSAHC. I’m therefore grateful so you’re able to loan administrator Stacy Schriever and you will Agent Debbie Patterson getting establishing us to TSAHC’s applications, hence managed to get easy for our house in order to in the long run purchase a beneficial house of one’s. -Felicia Bolton, Family Customer

TSAHC’s applications build homeownership possible for of many Texas families. I’m proud become a performing mortgage administrator during the TSAHC’s apps and so i might help parents such as the Pilgrims get to the lifelong desire buying property. -Nicole Newton, Mortgage Administrator having Prime Financing

“To shop for a home is daunting, however, I believe really privileged with my experience. I am really grateful towards pointers you to my personal loan administrator Tina Chumley, and you will Real estate agent Chelcy Gilliland considering in the real estate procedure. I am also pleased to own TSAHC, whoever programs forced me to buy a house in my own community therefore my personal man did not have to switch universities.” -Ellie Moss, Home Client